Improving Savings in the New Year

This post is sponsored by Regions Bank, member FDIC.

It’s a new year and after 2020, we are all ready for new beginnings. Many people like to set goals at the start of the year as a way to approach the months to come with a fresh readiness. An important area to think about when goal-setting is your finances. Being intentional about your finances can help improve your saving and spending habits. Ask yourself the following questions:

- Are there areas of my finances that I could improve or begin to work on? If so, what areas? (Some examples might be savings, bills, retirement, etc.)

- How can I better my banking habits? (Maybe set an appointment with a banker to discuss financial strategies, download a budget app, and/or listen to financial podcasts.)

- What is my savings goal for this year and how can I achieve it? (See below for one idea!)

52-Week Savings Challenge

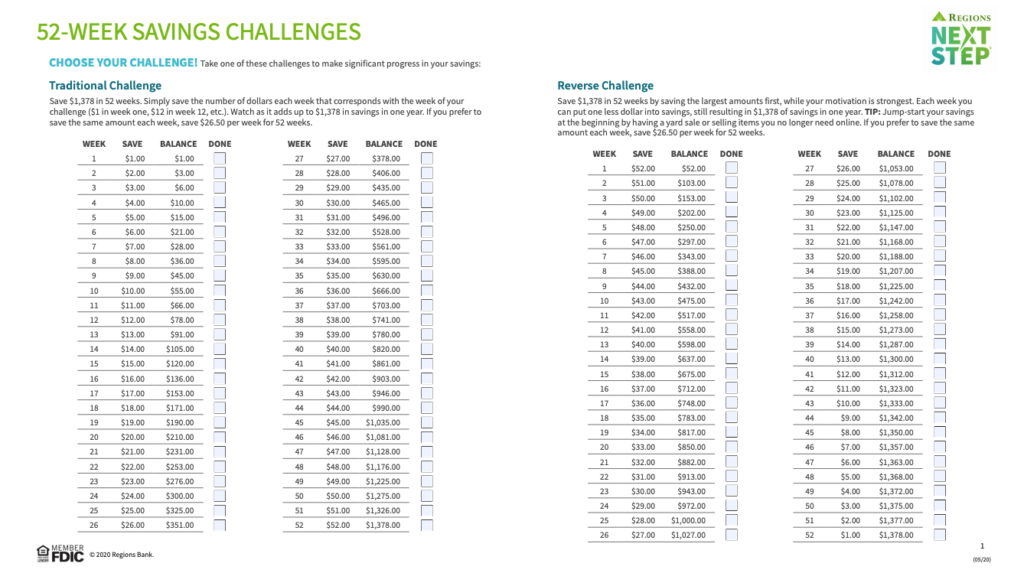

While savings goals can vary largely from person to person, Regions Next Step has a 52-Week Savings Challenge that can be a simple way for anyone to save $1,378 over the course of a year.

In the traditional version of this challenge, you increase your savings by $1 a week. So, the first week you save $1, the second week you save $2, the third week you save $3, and so on. By the end of the year, you will have saved $1,378. You could also choose to double the money saved each week, which would mean you would have $2,756 saved by the end of the year. Either way, this is a simple challenge to help you reach a savings goal.

If you’re looking to save even more for a specific goal like a down payment on a house or building an emergency fund, the 52-Week Savings Challenge worksheet also includes $5K and $10K challenges. Not only can these challenges help you reach larger savings goals quickly, but they are structured to make things easy too! These challenges break savings goals down into weekly cycles that build up and ease off every four weeks. This means that the lowest amount in each cycle is at the beginning of the month when many of us have bills due.

These savings practices could also be used to help kids save money. At the beginning of 2020, I sat down with my older children (almost 10 and almost 13) and talked about the importance of saving money, why we do it and the importance of goal setting. We then made a goal for each of them and broke it down by week. They then brainstormed ways to make money, such as doing chores around the house, babysitting and helping with my business. (Check out my article 3 Ways to Involve Your Kids in Your Business for some ideas on how to involve your kids in the financial side of running a business.)

4 Ways to Reduce Spending and Save Instead

If you’re looking for ways to make room in your budget to save more, here are four ways to reduce your spending and save instead:

- Evaluate your monthly bills: Are there expenses you are paying for that you could reduce, such as extra cable fees, late fees, services you don’t use, etc. Use this personal spending tracker and budget calculator to help.

- Eat out less: Eating out is costly. Try cooking more at home and planning which days you will treat yourself with a meal out.

- Shop around: Don’t be quick to buy something from your go-to retailer. Oftentimes if you search for an item online you can find a better deal somewhere else (maybe even from a small business!).

- Use coupons: Coupons are an excellent way to save on purchases you are already making. You can use online coupons that are available on store websites or through web browser extensions, coupons that come in the mail and coupons in newspapers to save money every week.

Download or print out the 52-Week Savings Challenge and get started on your savings today. For more inspiration on creating and sticking to a family budget, including how to save, check out this podcast.